Food Truck Business: How Expertly Trained New Venture Insurance Specialists Help Save Money on Business Auto Insurance

Starting a new business can be a daunting task, especially when it comes to navigating the world of insurance. Most new business owners are unfamiliar with the ins and outs of business auto insurance and unsure of how to find the best coverage and rates. Fortunately, there are expertly trained New Venture Insurance Specialists (NVIS) who can help food truck owners save money on their business auto insurance.

A food truck business is a great way to start your own business and offer delicious food to the public. With a food truck, you can travel to different locations, serve customers, and experience the freedom of being your own boss. However, owning a food truck comes with its own set of risks and responsibilities. To protect yourself and your business, you will need to get the right insurance coverage, which is where an NVIS can help.

On this page, we will discuss the process for successfully starting a new venture or food truck business, as well as how an NVIS can help food truck owners save money on their business auto insurance. We will also provide an overview of the types of coverage available, tips for finding the best rates, and more.

Steps for Starting a New Food Truck Business

Starting a food truck business requires careful planning, preparation, and organization. Here are some steps to follow when starting your own business:

1. Create a Business Plan: A business plan is like a roadmap for your startup and outlines the goals you want to achieve, how you plan to achieve them, and how you will measure success. This document will help guide you in the right direction and keep you on track throughout your journey.

2. Obtain Licenses and Permits: Before you can start operating your food truck, you will need to obtain any necessary licenses and permits from local and state authorities. This could include health permits, vending permits, and other forms of certification.

3. Find a Location: Once you have obtained all required permits and licenses, you will need to find a suitable location for your food truck business. Look for areas that have high foot traffic and are close to your target market.

4. Invest in Commercial Auto Insurance: As a business owner, you have a responsibility to protect your assets and employees. Investing in commercial auto insurance is one way to do this. Make sure you choose the right type and amount of coverage for your unique needs.

How an NVIS Can Help Food Truck Owners Save Money on Business Auto Insurance

An NVIS is an expertly trained insurance professional who specializes in helping new business owners find the best rates and coverage for their businesses. They understand that each business has different needs, so they take the time to get to know their clients and their businesses before recommending any policies or coverage options.

When it comes to finding business auto insurance for food truck owners, an NVIS can help by providing advice on the types of coverage available and how to get the best rates. They can also answer any questions you may have about the process or provide guidance on where to look for discounts or other savings opportunities.

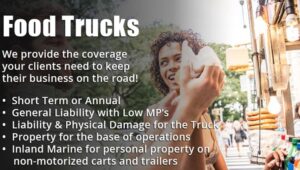

Types of Business Auto Insurance Coverage for Food Trucks

The type of coverage you choose will depend on the size and type of food truck you have, as well as the number of people you have working for you. Generally speaking, there are four main types of commercial auto insurance for food trucks:

1. Liability Coverage: This type of coverage provides protection if you or one of your employees is responsible for causing an accident or injury. This includes damages caused to another person’s property or medical bills resulting from an injury.

2. Collision Coverage: Collision coverage provides protection if your food truck is damaged due to an accident or collision with another vehicle or object. It also covers repairs if your vehicle is vandalized or stolen.

3. Comprehensive Coverage: Comprehensive coverage provides protection against damage caused by something other than a collision, such as fire, hail, windstorms, floods, theft, vandalism, or animal collisions.

4. Uninsured/Underinsured Motorist Coverage: This type of coverage provides protection if you are involved in an accident with another driver who does not have enough insurance or any at all to cover your damages or medical bills.

Tips for Saving Money on Business Auto Insurance for Food Trucks

There are several ways to save money on business auto insurance for food trucks:

1. Shop Around: Don’t be afraid to shop around for the best rates and coverage options. Compare quotes from multiple providers to make sure you’re getting the best deal possible.

2. Bundle Policies: Bundling your policies together with one provider can often result in discounts and savings opportunities. Consider bundling your commercial auto insurance with other policies such as workers’ compensation or general liability insurance.

3. Take Advantage of Discounts: Many providers offer discounts for things such as having multiple vehicles insured or having a good driving record. Ask your provider about any discounts they may offer so you can take advantage of them.

4. Choose Higher Deductibles: If you’re willing to take on more risk in exchange for lower premiums, consider increasing your deductibles. Just make sure you have enough money saved up in case you need it for an unexpected repair or accident claim.

Starting a new venture or food truck business can be an exciting but overwhelming process. It’s important to make sure you have the right insurance coverage in place to protect yourself and your business from any potential risks or liabilities that may arise during the course of operating your business.

An NVIS can help by providing guidance on the types of coverage available and how to get the best rates and discounts possible. With their expertise and advice, food truck owners can save money on their business auto insurance while still getting the protection they need.

Request help with your Startup business insurance from qualified professionals that deal with New Ventures everyday in AL,AR,DE,FL,GA,IA,IN,KS,KY,MD,ME,MS,NC,NE,NJ,OH,PA,SC,TN,TX and VA (855) 554-6321 .